Extra one time payment mortgage calculator

It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest. If you plan to stay in your house for a short time like 5 to 7 years then you might be better off focusing your money in some other investment.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Thats one extra monthly payment a year.

. You can save significant money on your student loans with a lump sum payment. Our calculator can factor in monthly annual or one-time extra payments. To interest savings wanting to sell their home or refinancing.

Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. Mortgage Payoff Calculator 2a Extra Monthly Payments. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

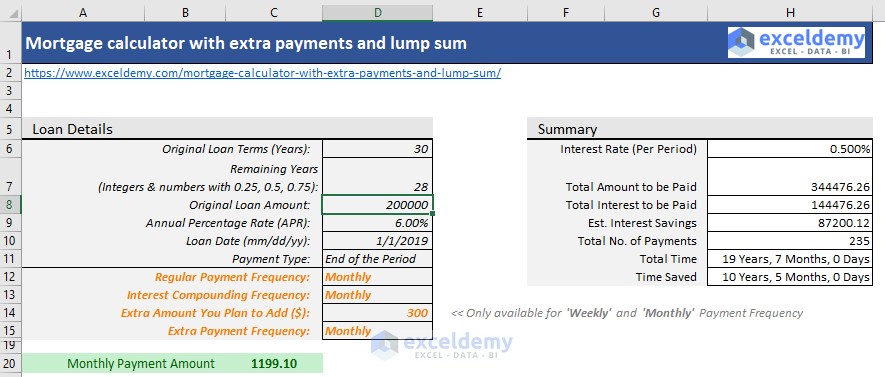

Mortgage Amount or current balance. The calculator lets you find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan. Borrowers who want an amortization schedule.

Mortgage Details Original Monthly Payment Lump Sum Payment. Meanwhile there are 52 weeks in a year. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether.

16 years 10 months. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. Monthly payment capital interest 94842.

For example lets assume you have 50000 in student loans at a 7 interest rate. New Loan Amount or Existing Loan Balance eg. If youre chipping away at a mortgage each month it can feel even longer.

You dont have to pay a lot of extra each month to make a significant difference in your loan payoff time. Check out the webs best free mortgage calculator to save money on your home loan today. Use an amortization schedule calculator.

Extra Payment Mortgage Calculator. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. The net effect is just one extra mortgage payment per year but the interest savings can be dramatic.

Lets assume you make a one-time lump-sum payment of 1000. Our calculator includes amoritization tables bi-weekly savings. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender. You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment. 9 years 6 months.

If you can scrape together the equivalent of one extra mortgage payment each year youll take on average four to six years off your loan. Who This Calculator is For. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format.

Bi-Weekly Mortgage Payment Calculator Terms Definitions. Is approaching 400000 and interest rates are hovering around 3. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. 3 Ways to Make an Extra Mortgage Payment. Whatever the frequency your future self will thank you.

Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. An additional 50 or even 25 extra principal each month may make a surprising difference. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Even just an extra payment. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Using my Mortgage Payoff Calculator Extra Payment.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. I have found that if I make an extra mortgage payment on say the 30th of the month I still save the interest from the balance reduction so in that sense it does matter if you make the extra payment. And she will be able to repay her loan completely in 11 years 4 months and 0 days.

Original Payment Lump-Sum Payment. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. 20 years 6 months.

As a result by the end of the year youll pay an equivalent of 13 monthly payments. We just refinanced to a 51 ARM with a 10 year amortization so we dont have too much time left now. You see that she can add any amount of extra payment to her regular monthly and regular extra recurring one payment.

You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. And an extra payment of 400 for months 7-36 you enter 100 for months 1-6 500 for months 7-9 and 400 for months 10-36.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. A one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest. Use our free Extra Payment Calculator to find out just how much money you are saving in interest by making extra payments on your auto home or other installment loans.

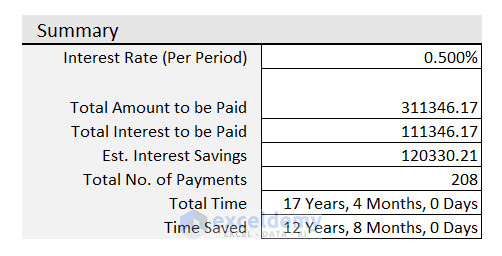

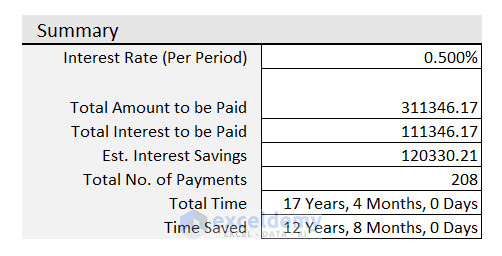

Thirty years is a long time. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. In the loan summary part.

If you pay every 2 weeks thats 26 half payments. 60000 one-time payment Monthly Payment PI Pay-off Time. However borrowers need to understand the.

Well likely pay it off within 5 years. Savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. 50000 one-time payment Pay-off Time.

8 years 2 months. Biweekly Mortgage Calculator with Extra Payments.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Mortgage Payoff Calculator With Line Of Credit

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Downloadable Free Mortgage Calculator Tool

Extra Payment Mortgage Calculator For Excel